How Advisors And Firms Actually Maximize Business For M&A Deals

Experts From Sanctuary Wealth, Berkshire Global Advisors, NewEdge Advisors And Householder Group Discuss Pre-Exit Growth Strategies

Technology Is Making Compliance Departments More Proactive

Compliance Veterans From Orion, RFG, Angeles And Surge Share How Technology Is Changing Compliance Departments Across The Industry

Through Your Clients’ Eyes: Wealthtech Advances The Client Experience

Wealthtech Has Already Changed The Client Experience And Clients Demand More, Which Can Open New Opportunities For Advisors And Wealthtech Firms

M&A Optimism Amid Lofty RIA Valuations, And Rising Costs For Small IBDs

Experts From NewEdge Capital Group, Prospera Financial Services, Berkshire Global Advisors And Fusion Financial Partners Discuss What’s Driving M&A In 2024

Wealthtech Trends That Dominated 2023, And Will In 2024

Executives From Morningstar, Opto Investments And Wealth.com Explain How Technology Is Changing The Game For Advisors And Their Firms

Generational Shifts Fuel M&A Optimism Amid Changing Macro Environment

M&A Landscape May Get A Boost From Succession Planning Needs, As Sellers Seeking Deal Assistance Grow Tired Of Waiting Out The Uncertain Economic Landscape

Broker-Dealer M&A Picks Up. Don’t Pop The Champagne Just Yet.

Four Summer Deals By LPL, Atria And Cetera Have The Industry Abuzz. Now Let’s Take A Closer Look At What’s Really Been Happening In IBD Deal Flow.

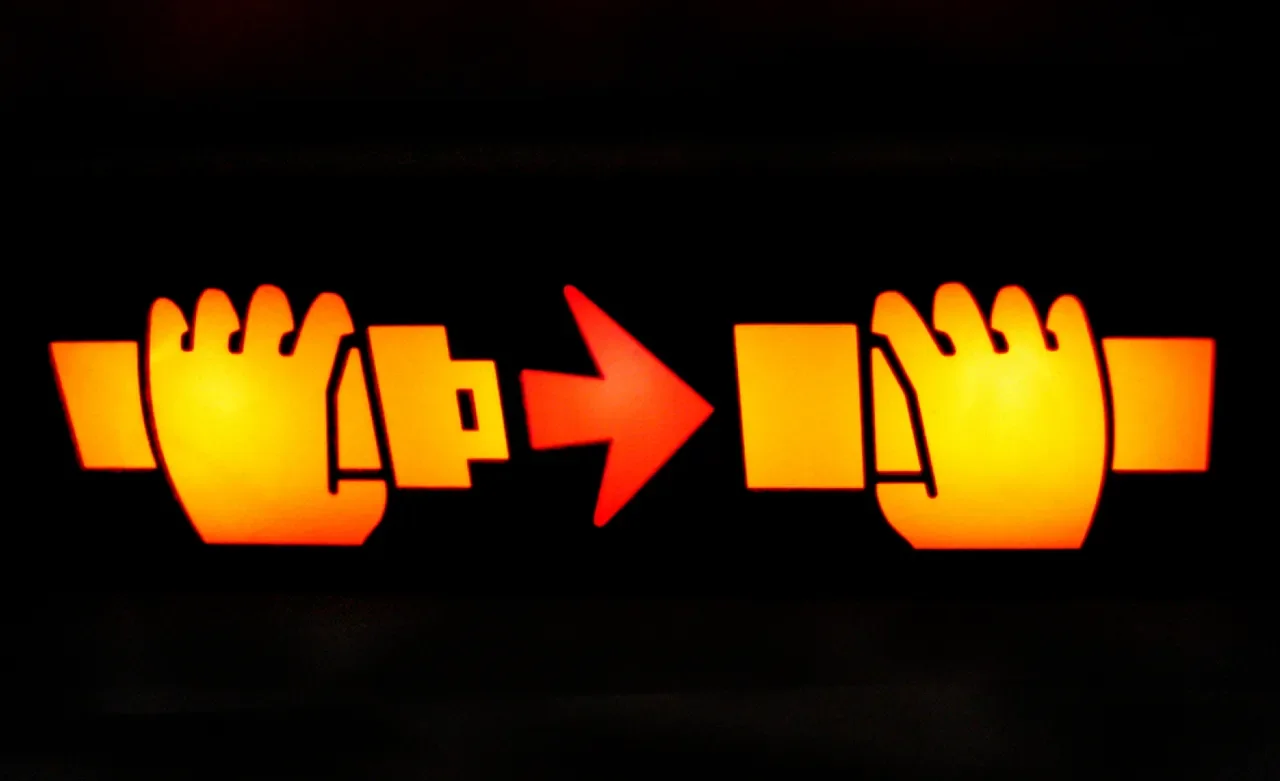

Buckle Up For Turbulence In Wealthtech

Like The Broader Tech Industry, Wealthtech Is Under Pressure To Perform More With Less Cash, So Be Wise About Your Tech Stack Partners

2023 Advisor Recruitment Trends Show Vitality Amid Unexpected Obstacles

Macro Volatility And Regional Banking Crisis Add X-Factors To Otherwise Robust Financial Advisor Recruitment Landscape For RIAs And Broker-Dealers